Cloud computing has brought in major changes to the financial services sector. It has revolutionized how businesses handle and store their data by offering a more economical approach. Once challenged by legacy systems, high operational costs, and scalability issues, financial institutions are now leveraging the cloud to enhance performance, security, and innovation.

Understanding Cloud Computing

Through cloud computing, organizations can access resources like servers, databases, applications, and analytics via the internet. Rather than managing physical infrastructure, companies access these resources on-demand from cloud providers, optimizing efficiency and agility.

Global Trends and Adoption

According to Deloitte, from 2016 to 2018, there was a notable rise in cloud adoption in the financial sector. Leading banks and investment firms now utilize cloud platforms for functions ranging from regulatory reporting to trading applications. Many firms are transitioning from private to multi-cloud environments, driven by the promise of greater flexibility and innovation.

Cloud computing’s dominance in IT budgets underlines its role as a transformative force. Financial services firms are increasingly embracing cloud as the foundation for modern operations, enabling them to redefine services, build resilience, and stay competitive.

1. Cost Reduction and Operational Agility

Cloud solutions help financial organizations reduce infrastructure costs, increase storage capacity, and support remote work. The flexibility offered by cloud environments ensures smooth operations regardless of employee location.

2. Real-Time Insights and Enhanced Customer Experience

Artificial Intelligence (AI) integrated with cloud services allows financial firms to gain timely insights into market trends and improve customer interactions using chatbots. These tools help enterprises to offers personalize experiences to customers, thereby, improving customer loyalty.

3. Compliance and Security Enhancements

Regulators demand strong security protocols in finance. Cloud providers meet strict standards and offer specialized cybersecurity services, helping institutions maintain compliance while protecting customer data from cyber threats.

4. Modernizing Legacy Infrastructure

Cloud adoption enables firms to update outdated systems and adopt modern digital solutions such as mobile banking, robo-advisors, and blockchain applications. As a result, enterprises can foster agility and enhance time-to-market for new services.

5. Improved Integration and Collaboration

Cloud platforms make it easier for banks to collaborate with fintech firms, third-party developers, and remote teams. Through the use of APIs and shared platforms, real-time data exchange is enabled, encouraging greater collaboration and creative solutions among various teams.

6. Leveraging Advanced Analytics and AI/ML

Cloud-based analytics and machine learning services empower financial institutions to detect anomalies, deliver personalized recommendations, and make data-driven decisions. These tools are essential for risk mitigation and product innovation.

7. Strengthening Fraud Detection

Cloud platforms process vast datasets from varied sources, allowing institutions to detect fraudulent activities such as identity theft, unauthorized transactions, and money laundering more effectively.

8. Enhancing Customer Relationship Management (CRM)

Cloud-based CRMs offer centralized customer data, enabling financial organizations to tailor services to individual needs. This has enabled organizations to enhance customer relationships and increases customer satisfaction.

Strategic Adoption in Financial Services

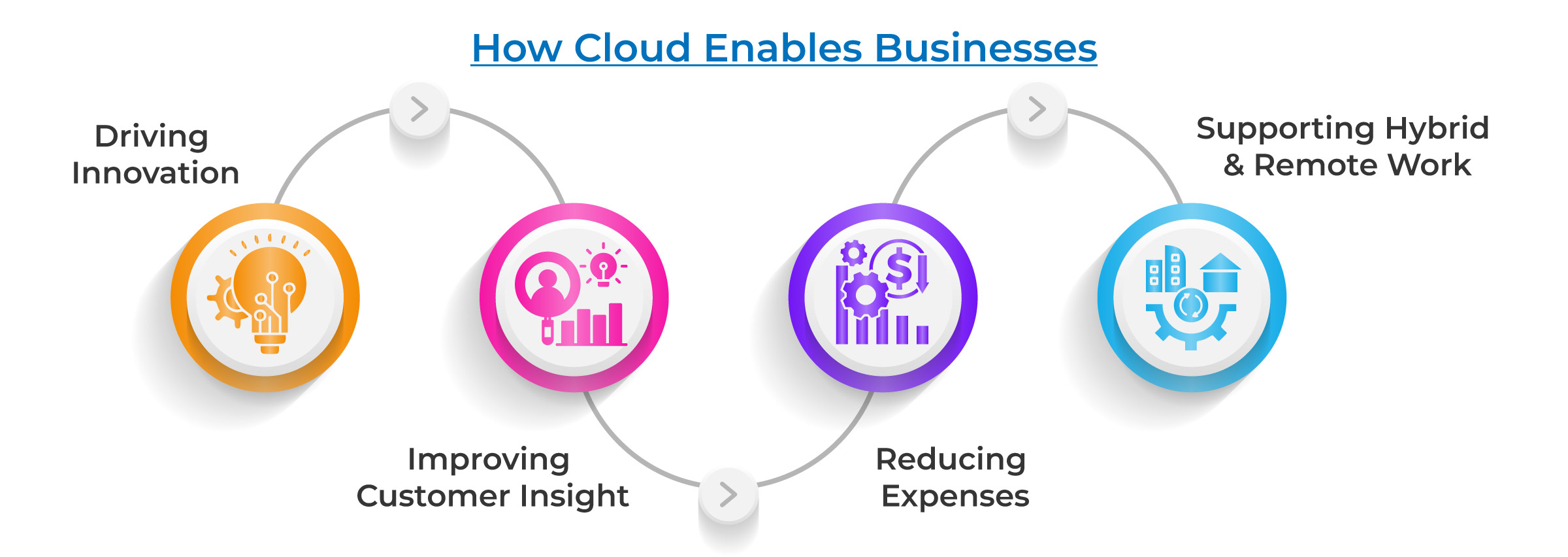

Cloud computing is now central to the strategic agendas of CIOs and executives in banking. Beyond being a cost-effective storage solution, it acts as a catalyst for organizational transformation, allowing financial firms to:

- Create market-ready, customer-centric offerings

- Consolidate and analyze enterprise data

- Remove departmental silos to improve collaboration

- Leverage cloud-delivered software to increase operational consistency

Rather than viewing cloud as just a tech upgrade, forward-thinking banks see it as a platform to drive revenue growth, optimize costs, and create new business models. Cloud solutions allow institutions to:

- Quickly roll out innovative digital services

- Improve customer insight and engagement

- Lower technology maintenance expenses

- Support hybrid and remote work environments

Case Study: Cloud in Healthcare Finance

A healthcare provider collaborated with a cloud solutions firm to modernize its finance operations. Struggling with outdated systems, the organization implemented a cloud-based platform that enhanced budgeting, compliance, and reporting. The result was improved efficiency, real-time financial insights, and reduced costs, showcasing the potential of cloud in complex industries like healthcare finance.

Implementation Strategies

- Gradual Transformation: Financial institutions across the world are increasingly shifting to cloud environment by choosing a hybrid or multi-cloud approach. This enables them to balance modern cloud benefits with existing infrastructure, minimizing disruption.

- Cloud Deployment Options: There are many ways in which enterprises can deploy cloud. They can opt for either private, public, or hybrid models based on their business requirements. In all cases, properly configured cloud environments can offer security that meets or exceeds on-premise systems.

- Agile Solution Design: External cloud vendors provide tools like machine learning and analytics out of the box, reducing development time and accelerating innovation.

- Vendor Flexibility and Governance: A multi-vendor approach helps avoid lock-in, promotes cost efficiency, and allows seamless transitions between providers. Establishing clear architecture and governance standards ensures consistency and security across platforms.

- Managing Security and Compliance: Security remains a top concern. Cloud providers manage infrastructure-level protection, while financial firms are responsible for application-level security. To make this model efficient, organizations must plan carefully and closely monitor systems.

Financial institutions can easily adapt to changing regulatory requirements as cloud services offer them flexibility. Capabilities like real-time liquidity monitoring and risk modeling help maintain compliance across jurisdictions, supporting functions like anti-money laundering and trade surveillance.

Conclusion

With cloud computing gaining momentum, the financial sector is set for a major transformation with improved efficiency, enhanced security measures, and ability to innovate faster. As financial organizations seek to remain agile and customer-centric, cloud technology provides the tools to reimagine their services, optimize performance, and secure long-term growth in an increasingly digital economy.